In today’s rapidly changing healthcare landscape, navigating the complexities of health insurance can be a daunting task. One of the most popular and often misunderstood options is high deductible health plans (HDHPs). With their lower premiums and increased flexibility, HDHPs have become a staple for many individuals and families seeking to balance their healthcare needs with their budget. However, the catchphrase “you get what you pay for” often rings true when it comes to these plans. Without a clear understanding of how they work, individuals can find themselves stuck with surprise medical bills, skyrocketing out-of-pocket expenses, and a sense of uncertainty about their healthcare coverage. In this blog post, we’ll demystify the world of high deductible health plans, exploring the benefits, drawbacks, and crucial considerations for those considering or already enrolled in these plans.

What is a High Deductible Health Plan (HDHP)?

In today’s healthcare landscape, the term “High Deductible Health Plan” (HDHP) is often thrown around, but what does it really mean? Simply put, a High Deductible Health Plan is a type of health insurance plan that requires policyholders to pay a higher amount of out-of-pocket expenses, typically in the form of a deductible, before the insurance coverage kicks in. This type of plan is designed to provide more cost-effective coverage for individuals who are generally healthy and don’t require frequent medical services.

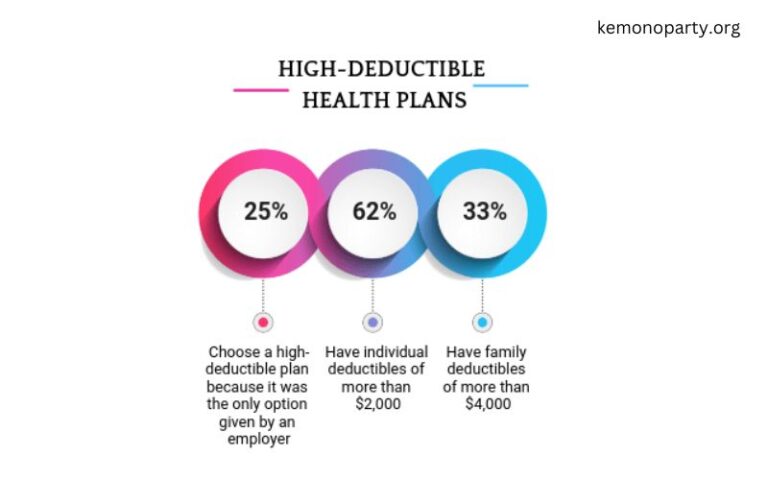

Typically, HDHPs have higher deductibles, which can range from $1,000 to $5,000 or more per year, depending on the plan. In exchange for paying a higher deductible, individuals with HDHPs often enjoy lower premiums, which can be a significant cost savings for those who are younger, healthier, and don’t require frequent medical care. This type of plan is often used by individuals who are self-employed, small business owners, or those who are not eligible for employer-sponsored health insurance.

HDHPs are often paired with a Health Savings Account (HSA), which allows individuals to set aside pre-tax dollars to cover medical expenses. This can be a significant benefit, as the funds contributed to an HSA can be carried over from year to year, and the account can be used to cover not just medical expenses, but also retirement healthcare costs. In this section, we’ll delve deeper into the benefits and drawbacks of HDHPs, as well as explore how they can be used to create a more cost-effective and sustainable healthcare strategy.

Benefits of HDHPs: Cost savings and more

When it comes to navigating the complex world of healthcare insurance, High Deductible Health Plans (HDHPs) have emerged as a popular option for individuals and families seeking to manage their healthcare expenses. And for good reason. HDHPs offer a unique set of benefits that can significantly impact an individual’s financial well-being. One of the most significant advantages of HDHPs is the cost savings they provide. By requiring policyholders to pay a higher deductible upfront, HDHPs incentivize individuals to take a more proactive approach to their healthcare, seeking medical treatment only when necessary.

In addition to cost savings, HDHPs also offer a range of other benefits that can enhance the overall healthcare experience. For example, HDHPs often encourage policyholders to take advantage of tax-advantaged savings accounts, such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts allow individuals to set aside pre-tax dollars for healthcare expenses, reducing their taxable income and, in turn, decreasing their overall tax liability. Furthermore, HDHPs often come with lower premiums, which can be particularly appealing to individuals or families who are on a tight budget. By offering a lower premium option, HDHPs provide individuals with more flexibility in their budget, allowing them to allocate funds elsewhere.

Key components of HDHPs: Deductible, copays, and coinsurance

As you navigate the complex landscape of health insurance, one term that is sure to catch your attention is High Deductible Health Plan (HDHP). But what exactly does it mean? A HDHP is a type of health insurance plan that requires its policyholders to pay a higher amount of money upfront, in the form of a deductible, before the insurance coverage kicks in. But that’s not all – HDHPs also involve copays and coinsurance, which can be just as confusing.

Let’s start with the deductible. This is the amount of money you must pay out of pocket for medical services or prescriptions before your insurance coverage begins. For example, if your deductible is $2,000, you’ll need to pay the first $2,000 of your medical expenses before your insurance coverage kicks in. Sounds simple, but the reality is that many people struggle to meet these high upfront costs, which can lead to financial stress and even delayed medical care.

Next, there are copays. These are fixed amounts of money you pay for specific services, such as doctor visits, lab tests, or prescription medications. Copays are usually a flat rate, so you’ll know exactly how much you’ll need to pay each time you visit the doctor. However, they can add up quickly, making it important to keep track of your expenses to avoid surprise bills.

Finally, there’s coinsurance. This is a percentage of your medical expenses that you pay after your deductible is met. For example, if your coinsurance is 20%, you’ll pay 20% of your medical expenses, and your insurance company will pay the remaining 80%. Coinsurance can be a significant financial burden, especially if you have ongoing medical expenses or multiple medical conditions.

Together, these three components – deductible, copays, and coinsurance – form the foundation of a High Deductible Health Plan. By understanding these key components, you can make more informed decisions about your health insurance and take control of your healthcare expenses.

How HDHPs work: The role of the deductible and out-of-pocket maximum

The concept of High Deductible Health Plans (HDHPs) can be daunting, especially for those who are new to the world of health insurance. At its core, an HDHP is a type of health insurance plan that requires individuals to pay a significant amount of money out-of-pocket before the insurance coverage kicks in. This is where the deductible comes in. A deductible is the amount of money that an individual must pay each year before their insurance coverage begins to pay for their medical expenses. For example, if an individual has a deductible of $2,000, they will be responsible for paying the first $2,000 of their medical expenses before their insurance coverage starts to pay.

But, what about the out-of-pocket maximum? This is an important concept to understand, as it can significantly impact an individual’s financial burden. The out-of-pocket maximum is the maximum amount of money that an individual will pay for their medical expenses in a year, including the deductible, copays, and coinsurance. Once an individual reaches their out-of-pocket maximum, their insurance coverage will start to pay 100% of their medical expenses for the rest of the year. For instance, if an individual has an out-of-pocket maximum of $6,000, they will be responsible for paying the first $6,000 of their medical expenses before their insurance coverage starts to pay 100%.

It’s essential to understand the relationship between the deductible and out-of-pocket maximum, as it can help individuals make more informed decisions about their health insurance coverage. By knowing how much they need to pay out-of-pocket before their insurance coverage kicks in, individuals can better plan their finances and make more informed decisions about their healthcare.

Understanding the differences between HDHPs and traditional insurance plans

As you navigate the complex landscape of healthcare insurance, it’s easy to get lost in the jargon and acronyms that seem to pop up at every turn. One of the most commonly misunderstood types of insurance plans is the High Deductible Health Plan (HDHP). While it may seem daunting, understanding the key differences between HDHPs and traditional insurance plans is crucial for making informed decisions about your healthcare coverage.

HDHPs are a type of insurance plan that requires policyholders to pay a higher deductible, typically in the range of $1,000 to $3,000 or more, before their insurance coverage kicks in. This is in contrast to traditional insurance plans, which often have lower or no deductibles. However, in exchange for the higher deductible, HDHPs often offer lower premiums, which can be a significant cost savings for individuals and families.

Another key difference between HDHPs and traditional insurance plans is the way that healthcare expenses are covered. With a traditional plan, insurance coverage typically applies immediately, and policyholders pay a smaller co-pay or co-insurance for each medical service. In contrast, HDHPs require policyholders to pay the full cost of healthcare expenses until they reach their deductible. At that point, the insurance coverage kicks in, and policyholders pay a smaller co-pay or co-insurance.

Understanding the differences between HDHPs and traditional insurance plans can help you make more informed decisions about your healthcare coverage and avoid costly surprises down the line. By choosing the right plan for your needs and budget, you can ensure that you receive the healthcare coverage you need, while also keeping your out-of-pocket costs in check.

Pros and cons of HDHPs: Weighing the benefits and drawbacks

The age-old debate: are high deductible health plans (HDHPs) a blessing or a curse? As you weigh the pros and cons of this type of insurance, it’s essential to consider both the benefits and drawbacks to make an informed decision about whether an HDHP is right for you. On the one hand, HDHPs can offer a range of advantages, including lower premiums and a greater sense of fiscal responsibility. With a higher deductible, you may be more mindful of your healthcare expenses and more likely to seek out cost-effective treatment options. Additionally, HDHPs often come with a Health Savings Account (HSA), which allows you to set aside pre-tax dollars for medical expenses, providing a valuable tax benefit.

On the other hand, HDHPs can also have significant drawbacks. For individuals who require frequent medical attention, the higher deductible can be a significant financial burden, potentially leading to financial stress and even debt. Moreover, HDHPs often come with limited provider networks, which may force you to seek care from a less-than-ideal provider. Furthermore, the out-of-pocket expenses associated with HDHPs can add up quickly, making it essential to carefully review your coverage and budget before enrolling in an HDHP. By considering both the benefits and drawbacks of HDHPs, you can make an informed decision about whether this type of plan is right for you and your healthcare needs.

How to choose the right HDHP for your needs

Choosing the right High-Deductible Health Plan (HDHP) for your needs is a crucial decision that requires careful consideration. With so many options available, it can be overwhelming to navigate the complex landscape of HDHPs. However, by taking the time to evaluate your healthcare needs and budget, you can make an informed decision that meets your unique requirements.

First, it’s essential to assess your healthcare needs. Are you a healthy individual who rarely visits the doctor, or do you have ongoing medical conditions that require frequent care? Do you have a family to cover, or are you an individual looking for a plan that suits your needs? Answering these questions will help you determine the level of coverage you require.

Next, consider your budget. HDHPs are designed to be more affordable, but the deductible can be steep. Are you willing to pay more upfront in exchange for lower premiums, or do you prefer a plan with a lower deductible but higher premiums? You’ll also want to consider any additional out-of-pocket expenses, such as copays and coinsurance.

Once you have a clear understanding of your healthcare needs and budget, you can start researching HDHPs. Look for plans that offer a range of provider networks, as this will give you more flexibility in choosing your healthcare providers. You may also want to consider plans that offer additional benefits, such as telemedicine services or wellness programs.

By taking the time to evaluate your needs and budget, you can choose the right HDHP for your unique situation. Remember, choosing the right plan is not a one-size-fits-all solution. It’s essential to prioritize your healthcare needs and budget to ensure you’re getting the coverage you need at a price you can afford.

Strategies for managing high out-of-pocket costs

As you navigate the complex landscape of high deductible health plans (HDHPs), it’s essential to develop strategies for managing those pesky out-of-pocket costs. After all, the purpose of HDHPs is to provide affordable coverage for individuals and families, but the reality can be far from it. With increasing medical expenses, you may find yourself struggling to keep up with the financial burden. That’s where effective planning and budgeting come into play. By setting aside a dedicated fund for medical expenses, you can alleviate some of the financial stress associated with HDHPs. Additionally, taking advantage of tax-advantaged accounts, such as Health Savings Accounts (HSAs), can help you save for future medical expenses and reduce your taxable income. It’s also crucial to prioritize your spending, focusing on essential services like preventive care and chronic condition management, while also being mindful of the costs associated with elective procedures and non-essential services. By adopting a proactive approach to managing your out-of-pocket expenses, you can reduce the financial strain of HDHPs and enjoy more peace of mind.

The impact of HDHPs on your healthcare budget

When it comes to managing your healthcare expenses, the last thing you want is a surprise bill that can derail your budget. High Deductible Health Plans (HDHPs) can be a double-edged sword, offering lower premiums in exchange for higher out-of-pocket costs. But what does this mean for your healthcare budget? The answer is crucial to understanding the true cost of healthcare under an HDHP.

In reality, HDHPs can be a significant financial burden, especially for individuals and families with ongoing health needs. With deductibles that can reach into the thousands, even a minor medical issue can quickly add up to a hefty bill. And that’s not even counting the copays and coinsurance that can further deplete your wallet. For those with chronic conditions, the costs can be even more daunting, as they may require frequent doctor visits, prescription medications, and other treatments.

To make matters worse, HDHPs often come with limited coverage, leaving you to pay for services that are not fully covered. This can mean that even with insurance, you may still be facing significant healthcare expenses. For those who are self-employed or have variable income, the financial uncertainty can be particularly unsettling. In this sense, HDHPs can be a financial risk, especially if you’re not prepared for the unexpected.

As you navigate the complexities of HDHPs, it’s essential to carefully review your plan’s details, including the deductible, copays, and coinsurance. By doing so, you can better understand the financial implications of your healthcare decisions and make informed choices that align with your budget and financial goals. By cracking the code of HDHPs, you can take control of your healthcare expenses and ensure that you’re not caught off guard by surprise bills.

How to navigate the health insurance market with an HDHP

Navigating the health insurance market with an HDHP can be a daunting task, especially for those who are new to the concept. With so many options available, it’s easy to feel overwhelmed by the sheer number of choices and complexities involved. But, with the right knowledge and tools, you can successfully navigate the market and find the perfect plan that meets your needs.

The first step is to understand your own health needs and priorities. What are your health concerns? Do you have any pre-existing conditions? Are you planning to start a family? Answering these questions will help you identify the type of coverage you need, such as a plan that covers preventative care, maternity services, or chronic condition management.

Next, research and compare different plans that offer HDHPs. Look for plans that have a network of healthcare providers, including doctors, specialists, and hospitals. Check the plan’s coverage levels, including the deductible, copays, and coinsurance. You should also review the plan’s prescription drug coverage and any limitations or restrictions that may apply.

In addition to researching plans, it’s also important to consider the cost of the plan. HDHPs often have lower premiums, but higher deductibles. You’ll need to consider whether the plan’s coverage and benefits outweigh the higher upfront costs.

Finally, don’t forget to review the plan’s out-of-pocket maximum, which is the maximum amount you’ll pay for healthcare services in a year. This amount can vary depending on the plan, so it’s important to understand what’s included and how it may impact your budget.

By taking the time to research and compare plans, you can find an HDHP that meets your needs and budget. With the right plan, you’ll have peace of mind knowing that you have the coverage you need to stay healthy and manage any unexpected medical expenses.

Common misconceptions about HDHPs: Debunking the myths

When it comes to High-Deductible Health Plans (HDHPs), there are many misconceptions that can lead to confusion and misunderstandings. One of the most common myths is that HDHPs are only for young, healthy individuals who don’t require frequent medical attention. However, this couldn’t be further from the truth. HDHPs are designed to be flexible and can be tailored to suit the needs of individuals from all walks of life.

Another misconception is that HDHPs are only for those who are willing and able to take on more financial risk. While it’s true that HDHPs require individuals to pay more out-of-pocket expenses upfront, the benefits of these plans far outweigh the costs. For example, HDHPs often offer lower premiums, which can be a significant advantage for individuals who are on a tight budget.

Another myth that needs to be debunked is that HDHPs are only suitable for those who have a large emergency fund. While it’s true that having a cushion of savings can be helpful in the event of unexpected medical expenses, HDHPs are designed to be flexible and can be tailored to suit the needs of individuals with varying financial situations.

As you can see, there are many misconceptions surrounding HDHPs. By understanding the facts and debunking these myths, individuals can make more informed decisions about their health insurance options and choose the plan that best suits their needs. In the next section, we’ll explore the benefits of HDHPs and how they can be a valuable addition to any healthcare strategy.

HDHPs and the Affordable Care Act (ACA): Implications and changes

The Affordable Care Act (ACA), also known as Obamacare, has had a profound impact on the healthcare landscape. One of the key provisions of the ACA was the introduction of high-deductible health plans (HDHPs) as a viable option for individuals and families. Prior to the ACA, HDHPs were often viewed as a niche product, primarily marketed to young, healthy individuals who were willing to take on more out-of-pocket expenses in exchange for lower premiums.

However, with the ACA’s push for greater healthcare access and affordability, HDHPs became a more mainstream option. The law’s individual mandate, which required individuals to purchase health insurance or face a penalty, further increased the demand for HDHPs. These plans offered a more affordable option for individuals who were either young and healthy, or those who were willing to take on more risk in their healthcare coverage.

In addition to the individual mandate, the ACA also introduced other changes that impacted HDHPs. For example, the law’s provision allowing for pre-tax contributions to a health savings account (HSA) made it more attractive for individuals to opt for an HDHP. This, in turn, has led to a surge in the popularity of HDHPs, as individuals seek to take advantage of the tax benefits and greater flexibility offered by these plans.

As the healthcare landscape continues to evolve, it’s essential to understand the implications and changes that HDHPs have undergone under the ACA. By grasping these nuances, individuals and families can make more informed decisions about their healthcare coverage, and navigate the complexities of the healthcare system with greater confidence.

How to take advantage of HDHPs and maximize your healthcare dollars

Unlocking the full potential of High-Deductible Health Plans (HDHPs) requires a strategic approach. By understanding the intricacies of these plans, you can transform your healthcare expenses from a burden into a valuable investment. One of the most significant benefits of HDHPs is the opportunity to build a tax-free savings account, which can be used to cover out-of-pocket medical expenses. By contributing to a Health Savings Account (HSA) or a Flexible Spending Account (FSA), you can set aside pre-tax dollars, reducing your taxable income and minimizing your overall healthcare costs.

Another key aspect of maximizing your healthcare dollars with HDHPs is to prioritize your medical expenses. By categorizing your expenses into essential and discretionary needs, you can make informed decisions about how to allocate your funds. This may involve delaying non-essential treatments or procedures, or seeking out more affordable alternatives. By taking a proactive approach to managing your healthcare expenses, you can ensure that you’re getting the most value from your HDHP.

Through careful planning and strategic decision-making, you can harness the power of HDHPs to achieve greater financial stability and peace of mind. By taking advantage of these plans, you can not only reduce your healthcare costs but also build a safety net for the unexpected expenses that life may bring. By cracking the code of HDHPs, you can unlock a brighter financial future, free from the uncertainty of healthcare expenses.

The future of HDHPs: Trends and predictions

As we navigate the complexities of the healthcare landscape, it’s crucial to stay ahead of the curve and anticipate the future of High Deductible Health Plans (HDHPs). With the ever-evolving demands of healthcare, market trends, and consumer preferences, it’s essential to decode the future of HDHPs.

Predictions suggest that HDHPs will continue to play a significant role in the healthcare landscape, driven by the growing need for cost-effective and personalized care. With the increasing adoption of telemedicine, digital health platforms, and value-based care, HDHPs will need to adapt to these changes to remain relevant.

One trend that’s likely to shape the future of HDHPs is the rise of lifestyle-based insurance plans. As consumers become more health-conscious and interested in prevention, insurance providers will need to offer plans that cater to these needs. This could include plans that incentivize healthy behaviors, such as fitness tracking and wellness programs, which can help reduce healthcare costs.

Another trend that’s likely to impact the future of HDHPs is the increasing importance of data analytics. With the abundance of healthcare data, insurance providers will need to leverage this information to better understand consumer behavior, predict healthcare needs, and develop more personalized plans. This could lead to the development of more tailored HDHPs that cater to individual consumers’ needs.

As the healthcare landscape continues to evolve, it’s crucial to stay informed about the future of HDHPs. By understanding the trends and predictions, you can better navigate the complexities of the healthcare system and make informed decisions about your health insurance options.