In the world of financial markets, spread betting has become a popular way for investors to speculate on the price movements of various assets, from stocks and commodities to indices and currencies. This high-stakes game requires a deep understanding of the mechanics, risks, and rewards involved, as well as the ability to navigate the complex landscape of odds and margins. But for those willing to take the leap, spread betting can offer a thrilling and potentially lucrative way to capitalize on market fluctuations. In this post, we’ll delve into the fundamentals of spread betting, exploring the ins and outs of how it works, the different types of bets, and the strategies for success. Whether you’re a seasoned trader or just starting out, this guide will provide you with the lowdown on spread betting, helping you to make informed decisions and maximize your returns in this fast-paced and dynamic market.

What is spread betting and how does it work?

Spread betting is a fascinating and complex financial instrument that has gained popularity in recent years, particularly among experienced traders and investors. But before diving into the intricacies of the game, it’s essential to understand the basics. In essence, spread betting is a form of financial trading that allows individuals to speculate on the price movement of various assets, such as stocks, commodities, currencies, and indices. The key difference between spread betting and traditional trading is that the latter involves buying and selling actual assets, whereas spread betting involves predicting the direction of the price movement, and the stakes are settled in cash.

The process begins with a spread, which is the difference between the bid and ask prices of the underlying asset. This spread is set by the broker, and it’s the margin on which the bet is made. For example, if the spread is 100-101, it means that the broker is willing to buy the asset at 100 and sell it at 101. As a spread bettor, you can either buy at the bid price and sell at the ask price, or buy at the ask price and sell at the bid price, depending on your market expectations. The key to success lies in correctly predicting the direction of the price movement, as the goal is to maximize profits while minimizing losses.

The game is played on a margin, which means that you’re only required to deposit a percentage of the total stake, and the broker will cover the remaining amount. This margin is typically set by the broker, and it’s designed to limit the risk of the trade. However, it’s essential to note that the margin is not a guarantee, and you can still incur losses if the market moves against your prediction.

In the next section, we’ll delve deeper into the world of spread betting, exploring the different types of spreads, the various markets you can trade, and the importance of setting a trading strategy. Whether you’re a seasoned trader or a newcomer to the world of financial trading, understanding the basics of spread betting is crucial for making informed decisions and maximizing your potential returns.

The risks and rewards of spread betting

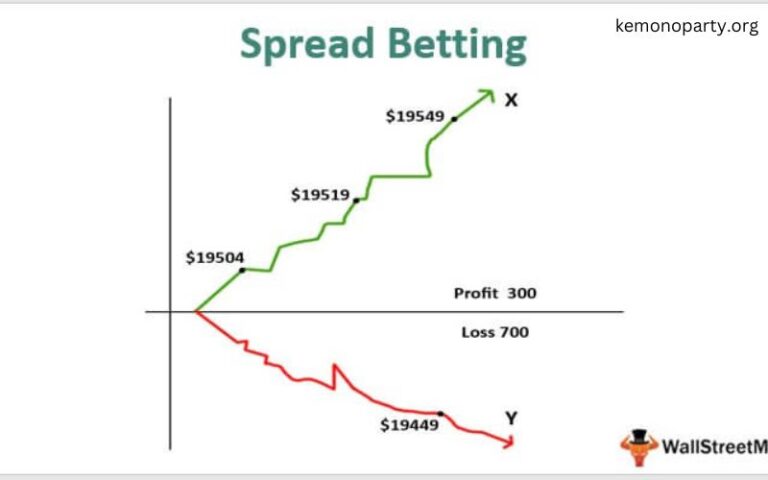

The world of spread betting is a thrilling one, where fortunes can be made and lost in the blink of an eye. But, before you dive headfirst into the fray, it’s essential to understand the risks and rewards that come with this high-stakes game. The truth is, spread betting is not for the faint of heart. It’s a high-risk, high-reward endeavor that requires a deep understanding of the markets, a steady nerve, and a solid strategy.

On the one hand, the potential rewards of spread betting are immense. With the ability to stake large amounts of money on the outcome of a particular event or market movement, the potential for profit is astronomical. But, on the other hand, the risks are equally as high. A single miscalculation or market shift can wipe out your entire stake, leaving you with nothing but a pile of debt.

It’s a delicate balance, to say the least. The key to success in spread betting lies in understanding the odds and the game, and being able to navigate the complexities of the market with ease. This means staying up to date with the latest news and developments, being able to read the market trends, and having a solid plan in place before you make your move.

In this blog post, we’ll delve into the world of spread betting, exploring the risks and rewards in detail, and providing you with the expert knowledge you need to succeed. Whether you’re a seasoned pro or just starting out, we’ll cover everything you need to know to make the most of your spread betting experience. So, let’s get started and take a closer look at the world of spread betting.

Understanding the odds and the spread

As you delve into the world of spread betting, one of the most crucial aspects to grasp is the concept of odds and the spread. This is the foundation upon which the entire game is built, and it’s essential to have a solid understanding of how it works to make informed decisions and maximize your potential returns.

In essence, the odds and the spread are two sides of the same coin. The odds refer to the probability of a particular event occurring, while the spread is the difference between the two possible outcomes. For example, in a football match, the odds might be 2.5 for the home team to win, and the spread might be 1.5 points. This means that the bookmaker is predicting the home team will win by more than 1.5 points, and the odds of 2.5 reflect the likelihood of that happening.

But here’s the thing: the odds and the spread are not always fixed. Bookmakers adjust them constantly in response to changing market conditions, such as the flow of bets, injuries to key players, and weather forecasts. This means that the odds and spread can shift rapidly, making it crucial to stay informed and adaptable in your trading decisions.

As you navigate the complex world of spread betting, it’s essential to keep a close eye on the odds and spread, and to adjust your strategies accordingly. This may involve hedging your bets, adjusting your stakes, or even switching to a different market altogether. By staying attuned to the ever-changing landscape of odds and spreads, you’ll be better equipped to make informed decisions and maximize your returns in the world of spread betting.

How to calculate the potential return on investment

Understanding the potential return on investment (ROI) is a crucial aspect of spread betting, as it allows you to make informed decisions about your trades and manage your risk effectively. The good news is that calculating the ROI is relatively straightforward, once you know the basics. To start, you’ll need to know the stake you’ve placed on a particular trade, the potential profit or loss, and the initial value of your account.

For example, let’s say you’ve placed a £100 stake on a trade with a potential profit of £150. In this scenario, your potential ROI would be calculated as follows: (potential profit – potential loss) / stake. In this case, the calculation would be (£150 – £100) / £100 = 50%. This means that if your trade is successful, you can expect a return on your investment of 50%.

However, it’s not just the potential ROI that’s important – you also need to consider the volatility of the market and the potential for losses. A high ROI may not necessarily mean that a trade is a good one, if it’s accompanied by high risk. By taking the time to calculate the potential ROI and considering the broader market conditions, you can make more informed decisions and manage your risk more effectively.

In this way, understanding the potential return on investment is a key part of the spread betting process, and can help you to achieve long-term success in the market. By combining this knowledge with a solid understanding of the underlying market and a clear trading strategy, you can make informed decisions and achieve your financial goals.

The difference between spread betting and traditional trading

The world of trading and investing can be a complex and intimidating space, especially for newcomers. One of the most significant distinctions that can be easily overlooked is the difference between spread betting and traditional trading. While both involve making financial decisions based on market movements, the key differences lie in their underlying mechanisms and the way they interact with the markets.

Traditional trading, also known as spot trading, involves buying and selling financial instruments, such as stocks, commodities, or currencies, at their current market price. The trader’s goal is to profit from the fluctuations in the market price, typically by holding onto the asset for a set period or selling it at a higher price than they bought it for. This approach requires a significant amount of capital, as the trader is required to deposit the full value of the trade upfront.

In contrast, spread betting is a form of financial trading that allows individuals to speculate on the price movements of various assets, including stocks, indices, commodities, and currencies. The key difference lies in the way that spread betting platforms operate. Instead of buying and selling assets at their current market price, spread betting traders bet on the direction of the price movement, essentially wagering on whether the price will rise or fall. This approach is often referred to as “betting on the movement” rather than “buying and selling”.

The beauty of spread betting lies in its ability to offer market access to individuals with limited capital. Unlike traditional trading, where the trader must deposit the full value of the trade, spread betting platforms typically require a deposit known as the “margin”, which is a fraction of the trade’s total value. This allows traders to gain exposure to the markets with significantly less capital, making it an attractive option for those who are new to trading or those who want to diversify their portfolio.

The benefits and drawbacks of spread betting

As you delve into the world of spread betting, it’s essential to understand the dual nature of this financial instrument. While it offers a unique set of benefits, it’s also important to acknowledge the potential drawbacks. On the one hand, spread betting provides a high level of flexibility, allowing you to trade on a wide range of markets, from global indices to individual stocks and commodities. This flexibility is particularly appealing to traders who want to capitalize on market fluctuations, as they can quickly adjust their positions to suit changing market conditions.

On the other hand, spread betting also comes with a higher level of risk, as you’re not buying or selling the underlying asset, but rather betting on the direction of the market. This means that losses can be significant, and even a small market move against you can result in a substantial loss of capital. Furthermore, the use of leverage in spread betting can amplify both gains and losses, making it essential to manage your risk exposure carefully.

In addition to these risks, spread betting also attracts significant fees, which can eat into your profits. These fees can include commission charges, bid-ask spreads, and overnight fees, all of which can add up quickly. To make the most of spread betting, it’s crucial to carefully weigh the benefits against the drawbacks, and to develop a solid trading strategy that takes into account the unique characteristics of this financial instrument. By doing so, you can harness the power of spread betting to achieve your financial goals, while minimizing the potential risks.

How to get started with spread betting

As you prepare to take the plunge into the world of spread betting, it’s essential to have a solid foundation in place. Getting started with spread betting can seem daunting, but with a clear understanding of the basics, you’ll be well on your way to navigating the markets with confidence. The first step is to choose a reputable online spread betting platform, which will serve as your gateway to the world of financial markets. Look for a platform that offers a user-friendly interface, competitive spreads, and a range of markets to trade. Once you’ve selected a platform, you’ll need to fund your account and open a trading position. This is where the magic happens, as you’ll be able to place bets on the price movement of a wide range of financial instruments, from stocks and indices to commodities and currencies. With a solid understanding of spread betting terminology, market analysis, and risk management strategies, you’ll be well-equipped to make informed decisions and maximize your returns. In this section, we’ll delve into the key steps to get started with spread betting, from platform selection to market analysis, and provide you with the expert guidance you need to succeed in this thrilling and unpredictable world.

Common spread betting strategies

As you delve deeper into the world of spread betting, it’s essential to develop a solid understanding of the various strategies that can help you navigate the market and maximize your returns. After all, the key to success lies not just in the odds, but in the approach you take to executing your trades. In this section, we’ll explore some of the most common spread betting strategies, from the tried-and-true to the more innovative and cutting-edge.

One of the most popular strategies is the “Trend Following” approach, which involves identifying and riding the momentum of a particular market or asset. This requires a keen eye for market trends and the ability to adapt to changing conditions. Another popular strategy is the “Mean Reversion” approach, which involves identifying overbought or oversold markets and betting on the reversal of the trend. This requires a deep understanding of market dynamics and the ability to identify patterns and anomalies.

For more aggressive traders, the “Range Trading” strategy can be a lucrative option. This involves identifying a specific range or band within which a market is trading and betting on the price remaining within that range. This strategy requires a high level of market awareness and the ability to quickly adjust to changing conditions.

Finally, the “Scalping” strategy involves making a series of small, high-frequency trades in order to capitalize on small price movements. This requires a high level of market awareness and the ability to execute trades quickly and efficiently.

While these strategies can be effective, it’s important to remember that spread betting is a high-risk activity and requires a solid understanding of the markets and the risks involved. As with any investment, it’s essential to do your research, set clear goals and risk parameters, and always trade with caution.

Managing risk and avoiding losses

As with any form of betting, spread betting is not without its risks. In fact, the high stakes and fast-paced nature of the game can make it easy to get caught up in the excitement and lose sight of the importance of managing risk. This is where discipline and self-control come in – it’s essential to set clear boundaries and stick to them in order to avoid losses.

One of the key ways to manage risk is to set a budget and stick to it. This means deciding on a maximum amount you’re willing to lose and not exceeding that amount, regardless of the outcome. It’s also important to diversify your bets, spreading your risk across multiple markets and assets to minimize the impact of any one loss.

Another crucial aspect of managing risk is to understand the odds and the potential payouts of each bet. This means doing your research and staying informed about the market, as well as being aware of the potential risks and rewards associated with each bet. By being informed and proactive, you can make more informed decisions and reduce your risk of losses.

Of course, even with the best planning and risk management, losses can still occur. It’s essential to be prepared for this eventuality and to have a plan in place for dealing with losses. This might include setting aside a portion of your budget for losses, or having a strategy for gradually reducing your bets as you experience losses.

By being proactive and responsible in managing risk, you can enjoy the thrill of spread betting while minimizing the potential for losses. Remember, it’s all about balance and discipline – with the right approach, you can make the most of your spread betting experience and achieve your goals.

The psychology of spread betting and how to stay disciplined

The psychology of spread betting is a delicate dance of emotions, risk, and reward. It’s a game that can be both thrilling and devastating, with the line between success and failure often blurred. One moment you’re riding high on a winning streak, and the next, you’re reeling from a devastating loss. It’s easy to get caught up in the excitement and impulsive decisions can be made, leading to reckless behavior and poor financial management.

Staying disciplined is crucial in spread betting, as it’s easy to get caught up in the thrill of the game and make decisions based on emotions rather than logic. A clear head and a solid strategy are essential to navigating the ups and downs of the market. It’s about being mindful of your emotions and taking a step back when necessary to reassess your position. This means avoiding impulsive decisions, setting realistic goals, and being patient in the face of uncertainty.

Effective risk management is also key to success in spread betting. This means setting stop-losses, limiting your exposure to the market, and being prepared to cut your losses when necessary. It’s also important to have a clear understanding of your trading goals and objectives, and to regularly review and adjust your strategy to ensure it remains aligned with your goals.

By staying disciplined and focused, you can avoid the pitfalls of emotional trading and make more informed decisions. Remember, spread betting is a game that requires patience, discipline, and a clear understanding of the market. By staying in control and avoiding the emotional rollercoaster, you can increase your chances of success and make the most of your spread betting experience.

How to analyze and interpret market data

As a spread bettor, gaining a deep understanding of market data is crucial to making informed decisions and increasing your chances of success. This is where the art of analysis and interpretation comes into play. By studying market data, you can uncover trends, patterns, and correlations that can help you make more accurate predictions about the future performance of a particular asset.

Market data is a treasure trove of information, but it can be overwhelming if you don’t know where to start. That’s why it’s essential to develop a systematic approach to analyzing and interpreting data. This involves identifying key indicators, such as moving averages, RSI, and Bollinger Bands, and using them to gauge market sentiment and trend direction.

Moreover, being able to filter out noise and focus on the relevant data is a critical skill for any spread bettor. This requires a keen eye for detail and the ability to distinguish between meaningful trends and random fluctuations. By combining technical analysis with fundamental analysis, you can gain a more comprehensive understanding of market dynamics and make more informed decisions.

In this section, we’ll dive deeper into the world of market data analysis, exploring the tools and techniques you need to stay ahead of the curve. We’ll also provide tips and tricks for filtering out noise, identifying key trends, and making informed decisions in the fast-paced world of spread betting. Whether you’re a seasoned trader or just starting out, understanding how to analyze and interpret market data is a vital skill that will help you achieve success in this exciting and dynamic market.

Understanding the role of emotions in spread betting

Emotions play a significant role in spread betting, and it’s essential to acknowledge the impact they can have on your trading decisions. The excitement of making a winning trade can quickly turn into reckless abandon, causing you to take on excessive risk or make impulsive decisions. On the other hand, a string of losses can lead to frustration, anxiety, and even fear, causing you to abandon your strategy or make desperate decisions.

The key to successful spread betting is to develop a mindset that separates your emotions from your trading decisions. This means being able to analyze market data objectively, without letting your emotions cloud your judgment. It’s crucial to understand that emotions are a natural part of the trading process, but they can also be a major obstacle to achieving success.

To manage your emotions effectively, it’s essential to develop a trading plan that outlines your goals, risk tolerance, and decision-making process. This plan should be based on your market analysis and research, rather than on emotional gut feelings. By following your plan, you’ll be able to make more rational decisions, even in the face of uncertainty or unexpected market movements.

In addition, it’s essential to learn how to recognize and manage emotional responses, such as fear, greed, and excitement. This can involve taking a step back, assessing your emotions, and re-focusing on your trading plan. With practice and experience, you’ll be able to develop a greater sense of emotional control, which will enable you to make more informed and effective trading decisions. By understanding and managing your emotions, you’ll be better equipped to navigate the ups and downs of spread betting and achieve long-term success.

How to set and achieve realistic goals

Setting and achieving realistic goals is a crucial aspect of spread betting, as it allows you to stay focused, motivated, and financially afloat. It’s easy to get caught up in the excitement of trading, but impulsive decisions can lead to devastating losses. By setting clear objectives, you can create a framework for success and make informed decisions that align with your financial goals.

To set realistic goals, start by assessing your financial situation, including your budget, risk tolerance, and available capital. This will help you determine the right amount to invest and the level of risk you’re comfortable taking on. Next, identify specific goals you want to achieve, such as a daily profit target or a weekly return on investment. Make sure these goals are measurable, achievable, and relevant to your overall spread betting strategy.

Achieving realistic goals also requires discipline and emotional control. It’s essential to avoid getting caught up in the euphoria of a winning trade or the despair of a losing one. By sticking to your strategy and avoiding impulsive decisions, you can increase your chances of long-term success and reduce your exposure to market volatility. By setting and achieving realistic goals, you’ll be able to navigate the ups and downs of spread betting with confidence and achieve your financial objectives.

Staying up to date with market news and trends

In the fast-paced world of spread betting, staying informed is key to making informed decisions and staying ahead of the game. The financial markets are constantly in flux, with news and trends emerging at a rapid pace. It’s essential to stay up to date with the latest developments, not just to stay ahead of the curve but also to avoid falling victim to unexpected market shifts.

By staying informed, you’ll be able to identify potential opportunities and threats, allowing you to adjust your spread betting strategy accordingly. This could involve monitoring economic indicators, following news reports, and keeping an eye on market trends. By doing so, you’ll be able to anticipate potential market movements and make data-driven decisions.

In addition, staying up to date with market news and trends will also help you to identify potential pitfalls and avoid costly mistakes. By staying informed, you’ll be able to recognize potential trading traps and sidestep them, ensuring that your spread betting activities remain profitable and sustainable.

In today’s digital age, it’s easier than ever to stay informed. With the abundance of financial news sources and market analysis available online, you can access the information you need at the touch of a button. From financial news websites and social media platforms to mobile apps and online trading platforms, the tools are available to help you stay ahead of the game. By taking the time to stay informed, you’ll be well on your way to becoming a successful spread better.

Advanced techniques for experienced spread betters

As you become more seasoned in the world of spread betting, you may be looking to take your skills to the next level. Advanced techniques can be a game-changer for experienced spread betters, allowing them to maximize their profits and minimize their losses. One such technique is the use of hedging strategies, which involve placing multiple bets on different outcomes to ensure a profit, regardless of the outcome. This can be particularly effective in volatile markets, where sudden changes in price can catch even the most seasoned traders off guard.

Another advanced technique is the use of scalping, which involves making a large number of small trades in a short period of time. This can be a high-risk strategy, but it can also be highly rewarding if executed correctly. Experienced spread betters may also use techniques such as spread betting arbitrage, which involves taking advantage of price discrepancies between different markets or brokers.

Additionally, advanced spread betters may also employ strategies such as news-based trading, where they use market-moving events to inform their trading decisions. This can be particularly effective in markets that are heavily influenced by news and events, such as forex or commodities.

Overall, advanced techniques can be a powerful tool for experienced spread betters, allowing them to take their trading to the next level and reap greater rewards. However, it’s essential to remember that these techniques require a high level of expertise and understanding of the spread betting market, and should only be attempted by those who have a solid foundation in the basics of spread betting.